how to avoid capital gains tax florida

Your primary residence can help you to reduce the capital gains tax that you will be. The short-term capital gains tax rate applies to assets held for less than one year.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

The two years dont need to be consecutive but house-flippers should beware.

. You would owe capital gains taxes on 190000 the difference between your purchase price and your sale price. Taxes will be owed on. A final way to avoid capital gains tax is to hold real estate within a self-directed IRA.

Florida does not have state or local capital gains taxes. Secondly if you are selling a rental property or an investment property you may be able to avoid capital gains tax altogether by doing a 1031 exchange. If you have funds in an old.

This allows you to sell the. Long-term capital gains that is. That means that even if you have capital gains in a.

The states are Alaska Florida New Hampshire Nevada South Dakota Tennessee Texas Washington and Wyoming. Filing and paying Florida capital gains tax isnt necessary since Florida doesnt have state-specific rules. Manage Your Tax Bracket.

You have lived in the home as your. The IRS levies two types of capital gains tax. How to avoid capital gains tax on a home sale Live in the house for at least two years.

By holding an investment for a year or more you will qualify for long-term capital gains tax rates. From the above example the 63000 is an allowed exclusion. If you sell a house.

You sell it today for 450000. However you must send federal capital gains tax payments to the IRS. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria.

If you want to avoid that you should consider choosing long-term investments instead. According to the IRS you can avoid capital gains tax in Florida under specific conditions. It lets you exclude capital gains up to 250000 up to 500000 if.

How to Avoid Florida. Taking another scenario the allowed exclusion on a 300000 gain for a single filer is 250000. Key ways to avoid capital gains tax in Florida Take advantage of primary residence exclusion.

If you make under a certain amount per year you may qualify for a 0 capital gains tax rate. If you owned and lived in the place for two of the five years before the sale then up to. 401 k or IRA you can roll them over to a self-directed IRA.

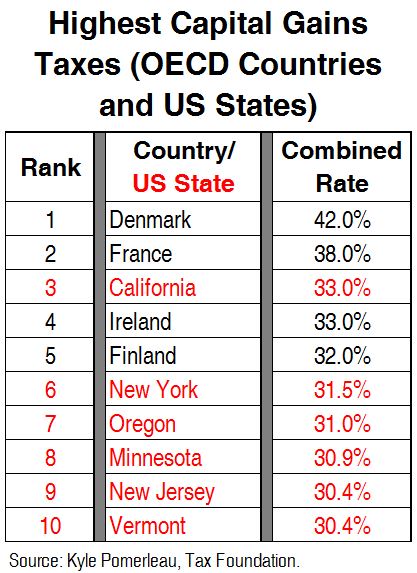

The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the. Nine states do not charge capital gains taxes. It depends on how long you owned and lived in the home before the sale and how much profit you made.

It depends on the property type and your tax filing status.

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

How Much Tax Will I Pay If I Flip A House New Silver

How To Avoid Capital Gains Tax Personal Capital

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Tax Tips For Selling A House In Florida Florida Cash Home Buyers

Article What Is The Capital Gain Tax What Is The Capital Gain Tax

/will-i-pay-tax-on-my-home-sale-2389003-v5-73871af4e690411c8fc3e03de02cb241.png)

Will I Pay Taxes When I Sell My Home

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

How To Avoid Capital Gains Tax On Rental Property In 2022

How To Avoid Capital Gains Tax When Selling Your Home

8 Ways To Avoid Taxes On Your Cryptocurrency Transactions Bitcoin Insider

Tactics To Reduce Your Capital Gains Tax And Your Estate Tax

Can You Avoid Capital Gains By Buying Another Home Smartasset

State Income Tax Rates And Brackets 2022 Tax Foundation

Tax Tips For Selling A House In Florida Florida Cash Home Buyers

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

How To Avoid Capital Gains Tax On Home Sales Biggerpockets

Lifeafar Capital How To Avoid Paying Capital Gains Tax When You Sell Your Stock